|

【Editorial note】Before cancelling your taxes, completing all

necessary tax-related tasks is important. Depending on your situation, you may

be eligible for exemption, immediate processing, or limited-time express

processing of tax clearance certificates. It's important to understand how to

use the electronic tax bureau cancellation system and be aware of any legal

risks in cancelling your taxes. Hargent will provide a comprehensive analysis

of the tax cancellation process for you. |

01

税务注销流程

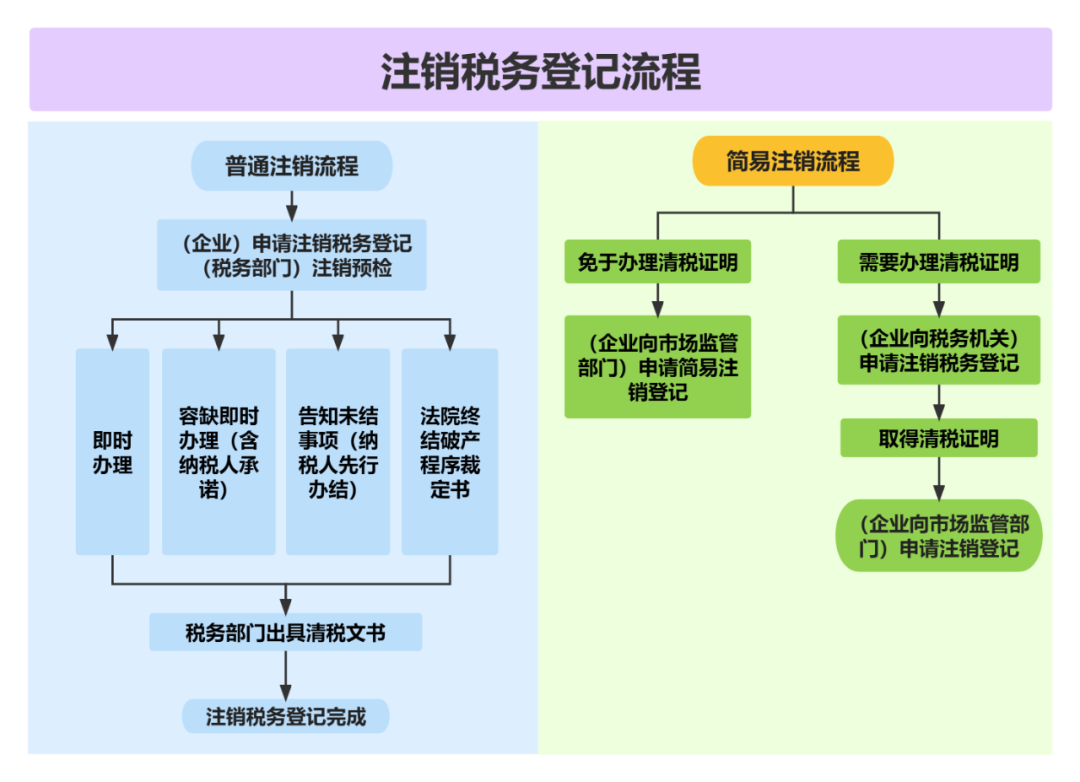

税务注销包括普通注销与简易注销两种方式,其中简易注销又分为免于办理清税证明与需要办理清税证明两种情形,各类注销流程存在差异。

▲ 注销税务登记办理流程图

02

Set Sail for the Sea, With Tax Benefits - Analysis of the Types of VAT Export Refund (Exemption) and Key Points of Declaration Practice

2024-10-22read:47second

Enterprise Must Read! The New Policy of Water Resource Tax Reform Has Been Introduced, And This Article Summarizes the Key Points of Policy Changes

2024-10-22read:52second

The 'Crime' and 'Punishment' of Tax Violations: A Must-Read Guide for Financial and Tax Personnel

2024-09-12read:47second

Cui Hua

Cui Hua

Partner

cuihua@hztax.net

Liu Daping

Liu Daping

Partner

liudaping@hztax.net

Xu Miaomiao

Xu Miaomiao

Manager

xumiaomiao@hztax.net

This website uses cookies to ensure you get the best experience on our website.