New policies have been released to help struggling businesses in the service industry. Homeowners who received reduced or waived rent may be eligible for tax reductions or exemptions in 2022 if they can show financial hardship. Local authorities should implement these regulations as needed.

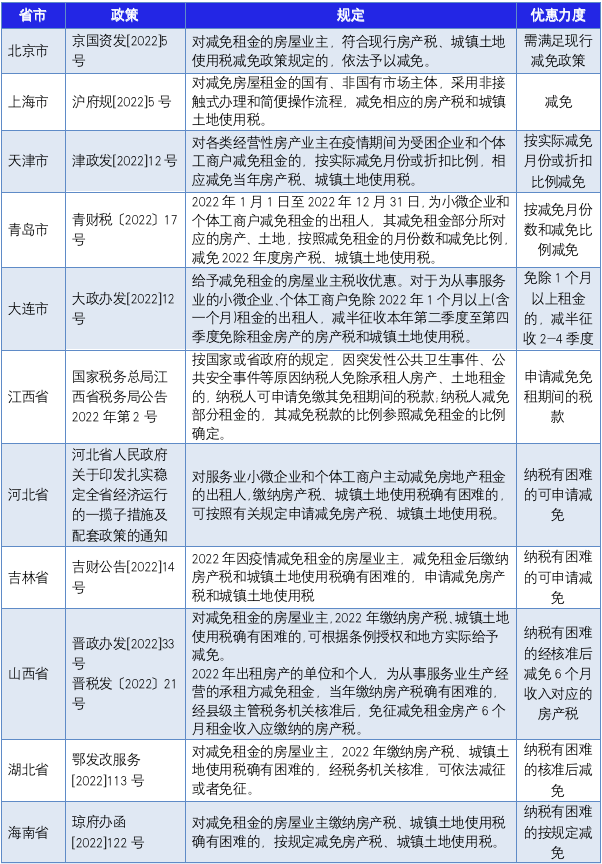

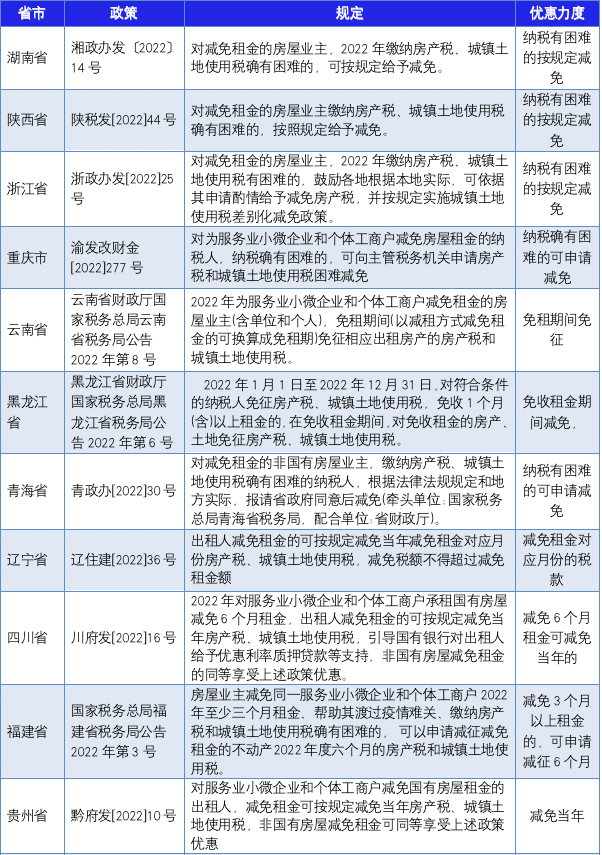

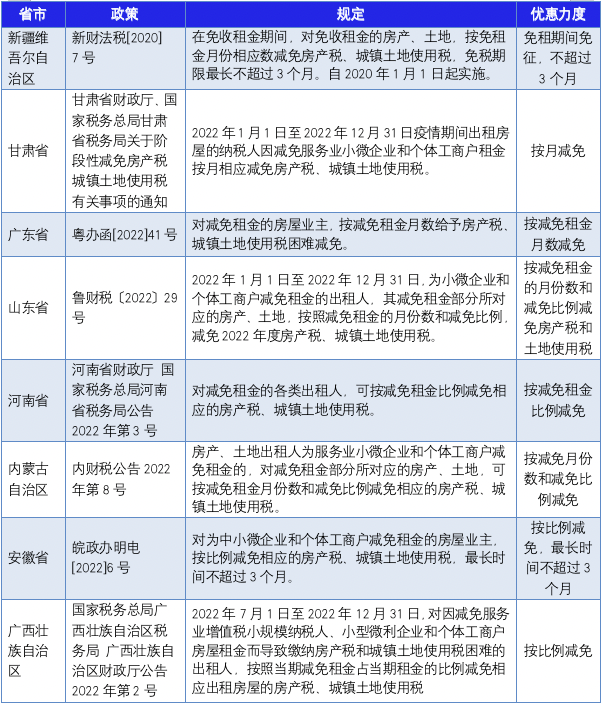

信心大增!2022年新冠疫情期间各地对减免租金的房产税、城镇土地使用税优惠

为帮助服务业领域困难行业渡过难关、恢复发展,国家发展改革委 财政部、税务总局等印发《关于促进服务业领域困难行业恢复发展的若干政策》的通知(发改财金〔2022〕271号)。其中,对减免租金的房屋业主,2022年缴纳房产税、城镇土地使用税确有困难的,鼓励各地可根据条例授权和地方实际给予减免。

为了减轻减免租金的房屋业主的负担,大部分省市的政府部门或税务局陆续出台了房产税和城镇土地使用税减免税规定,华政小编搜集整理了相关政策,对减免标准大致归纳总结以下四类:

1.上表中部分省市出台了税务文件,大部分省市是政府出台的文件,具体执行中还需了解当地税务机关的具体执行尺度哦。

2.关于减免租金的相关会计处理,请参考以下三个文件:

(1)《新冠肺炎疫情相关租金减让会计处理规定》(财会[2020]10号)

(2)《财政部关于调整<新冠肺炎疫情相关租金减让会计处理规定>适用范围的通知》(财会[2021]9号)

(3)《财政部关于适用<新冠肺炎疫情相关租金减让会计处理规定>相关问题的通知》(财会[2022]13号)

Set Sail for the Sea, With Tax Benefits - Analysis of the Types of VAT Export Refund (Exemption) and Key Points of Declaration Practice

2024-10-22read:474second

Enterprise Must Read! The New Policy of Water Resource Tax Reform Has Been Introduced, And This Article Summarizes the Key Points of Policy Changes

2024-10-22read:473second

The 'Crime' and 'Punishment' of Tax Violations: A Must-Read Guide for Financial and Tax Personnel

2024-09-12read:524second

This website uses cookies to ensure you get the best experience on our website.