|

【Editorial note】In 2023, State-owned Assets Supervision and Administration Commission of the State Council optimized the central enterprise operation indicator system to "one profit and five ratios", which includes total profit, asset liability ratio, operating cash ratio, return on net assets, R&D investment intensity, and overall labor productivity. Hargent Research Institute and China Construction Enterprise Management Association compiled and published the "Research Report on Finance and Taxation of Listed Companies in the Chinese Construction Industry", which analyzes the trend and characteristics of the "one profit and five ratios" of listed construction enterprises in the past four years from the perspectives of overall situation, key detailed industries, and leading enterprises (top 20 enterprises in terms of operating income). This article is an analysis of return on net assets. |

01

整体情况

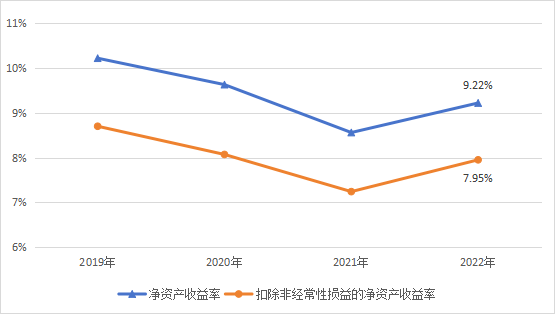

2019年至2022年,建筑业上市公司的净资产收益率整体呈先降后升趋势。受经济下行、行业盈利能力下降影响,前三年下降至8.56%,2022年上升至9.22%,扣除非经常性损益的净资产收益率上升至7.95%,盈利能力有所提升。近年来,建筑企业根据市场发展需求,不断优化和调整产业链,有效降低企业成本开支,提高资源利用效率,积极应对宏观环境带来的负面影响,盈利能力稳定。(见下图)

02

重点行业情况

03

二十强企业情况

左右滑动查看更多

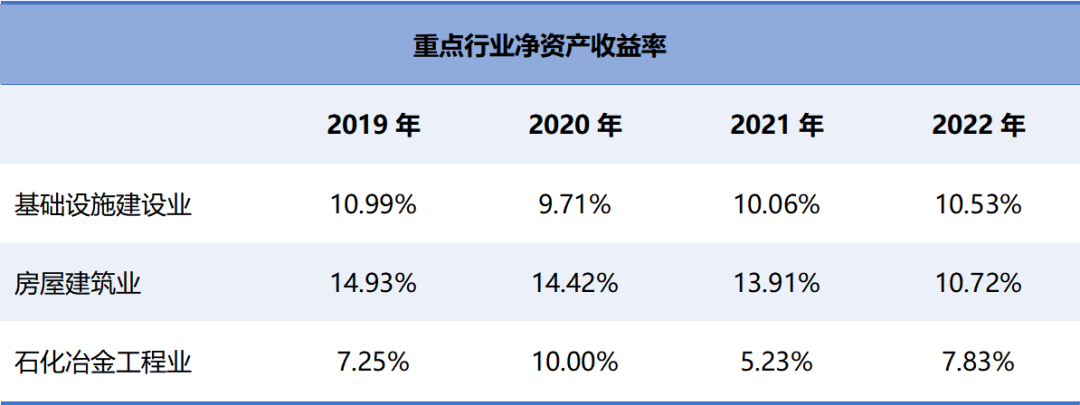

《中国建筑业上市公司财税研究报告》已连续发布六年,2023版报告以126家建筑业上市公司公开的财务信息数据为基础,收集近四年469份年报、18000多条基础数据,对2019年至2022年建筑业上市公司财税情况按明细行业进行分类,选取基础设施建设、房屋建筑、石化冶金工程为重点行业,分析行业内企业的财务指标和纳税指标的变动趋势及影响,同时特别分析了营收二十强企业的各项指标,突出展示了重点明细行业、行业龙头企业财务和税务情况的走势与特征。报告的付梓,客观反映了行业上市公司财务和纳税实际情况,有助于该行业企业对照同行,总结企业财税管理的得失,为行业内企业、税务机关、行业协会等各利益相关者评价纳税人税负变化,提供了周期完整、高度可比、专业可信的参照系,树立了税务专业服务组织开展分行业上市公司财税研究的典范。

Set Sail for the Sea, With Tax Benefits - Analysis of the Types of VAT Export Refund (Exemption) and Key Points of Declaration Practice

2024-10-22read:473second

Enterprise Must Read! The New Policy of Water Resource Tax Reform Has Been Introduced, And This Article Summarizes the Key Points of Policy Changes

2024-10-22read:471second

The 'Crime' and 'Punishment' of Tax Violations: A Must-Read Guide for Financial and Tax Personnel

2024-09-12read:524second

This website uses cookies to ensure you get the best experience on our website.